WvdW Financial Services

WelcomeAt WVDW we specialize in alleviating the burdens of SARS, accounting and financial services complexities, offering comprehensive financial solutions tailored for both individuals and businesses. With a commitment to quality and a team of qualified professionals, we integrate advanced technology and AI to deliver personalized service. Our mission and vision are centred on empowering business owners with the tools they need to enhance operations and provide all clients with the comfort and confidence they seek.

Individual Services

At WVDW we will tackle your tax from the beginning to the end…of the tax year.

Organizational Services

Allow us to manage your Business Financial administration so you can focus on growing and managing your core business.

Trust Services

We provide comprehensive accounting, taxation, and trust fiduciary services, including trust registration, corporate trustee services, and meticulous accounting record maintenance, ensuring your financial and fiduciary needs are expertly managed.

Wealth Creation & Protection

Our Wealth Division, in conjunction with trusted partners’ Capital, aid clients in ensuring long-term wealth creation and protection.

Why WVDW

What We Can Do For You

We take care of SARS and accounting hassles, ensuring compliance and peace of mind for our business as well as our individual clients.

Quality service and qualified staff ensure accuracy, reliability, and professionalism in all financial matters.

Advanced Tech and AI-based solutions streamline processes whilst we maintain a personal touch, enhancing efficiency and effectiveness.

Our vision and mission-driven approach aligns with clients’ goals, fostering trust and long-term partnerships.

We deliver tools and services for owners to run their businesses better, empowering them with insights and resources for business enablement and informed decision-making.

Our services provide clients with comfort, knowing their financial affairs are in capable hands, allowing them to focus on other aspects of their business and personal lives with confidence.

Access Our Different Services

Conveniently Arranged By Category

FAQ

Frequently Asked Questions

Below an extract of questions that are frequently asked and their respective answers. You are welcome to see if your query is addressed here, or on the full FAQ’s page (accessible via the Further FAQ’s button below). Alternatively you are welcome to contact us directly.

When Should I Submit A Personal Tax Return To SARS?

- When you conduct any trade (own business) in South Africa.

- If you’re a South African tax resident who conducted any trade.

- If you received an allowance such as a travel, subsistence or office bearer allowance. (Check your IRP5/IT3(a) if you are unsure.

- If you hold any funds in foreign currency or assets outside South Africa that have a combined total value of more than R225 000 at any stage during the tax year.

- If you have Capital Gains or Capital Losses exceeding R40 000.

- If you had any income or Capital Gain from funds in foreign currency or assets outside the Republic attributed to you.

- If you hold any rights in a Controlled Foreign Company.

- If you’ve received an Income Tax Return or if you were asked to submit an Income Tax Return for the tax year.

What Are The Requirements For A VAT Registered Business?

- Include VAT in all prices

- Charge and collect VAT

- Submit Returns and Payments

- Issue Tax Invoices

- Maintain Adequate Records

What Does Tax Risk Insurance Cover?

- Income Tax Audits

- VAT

- Employees Tax Audits

- Capital Gains Tax Audits

- Dispute Resolution Hearings

- Appeals to the Tax Board | Court

About WvdW

Governance & Regulations

We are dedicated to empowering our clients effective management of their personal and business interests by engaging with our comprehensive range of financial services offerings. Through our commitment to a robust enablement and adherence framework, we provide the necessary support for clients to navigate regulatory requirements seamlessly whilst enabling their endeavors. With stringent policies, transparent procedures, and ongoing monitoring, we prioritize compliance, transparency, and ethical conduct in every aspect of our operations. By upholding the highest standards of integrity and accountability, we safeguard the interests of our clients and stakeholders, enabling them to focus on achieving their personal and business goals with confidence.

Is Your Compliance Up To Date?

Need Financial Enablement?

Media

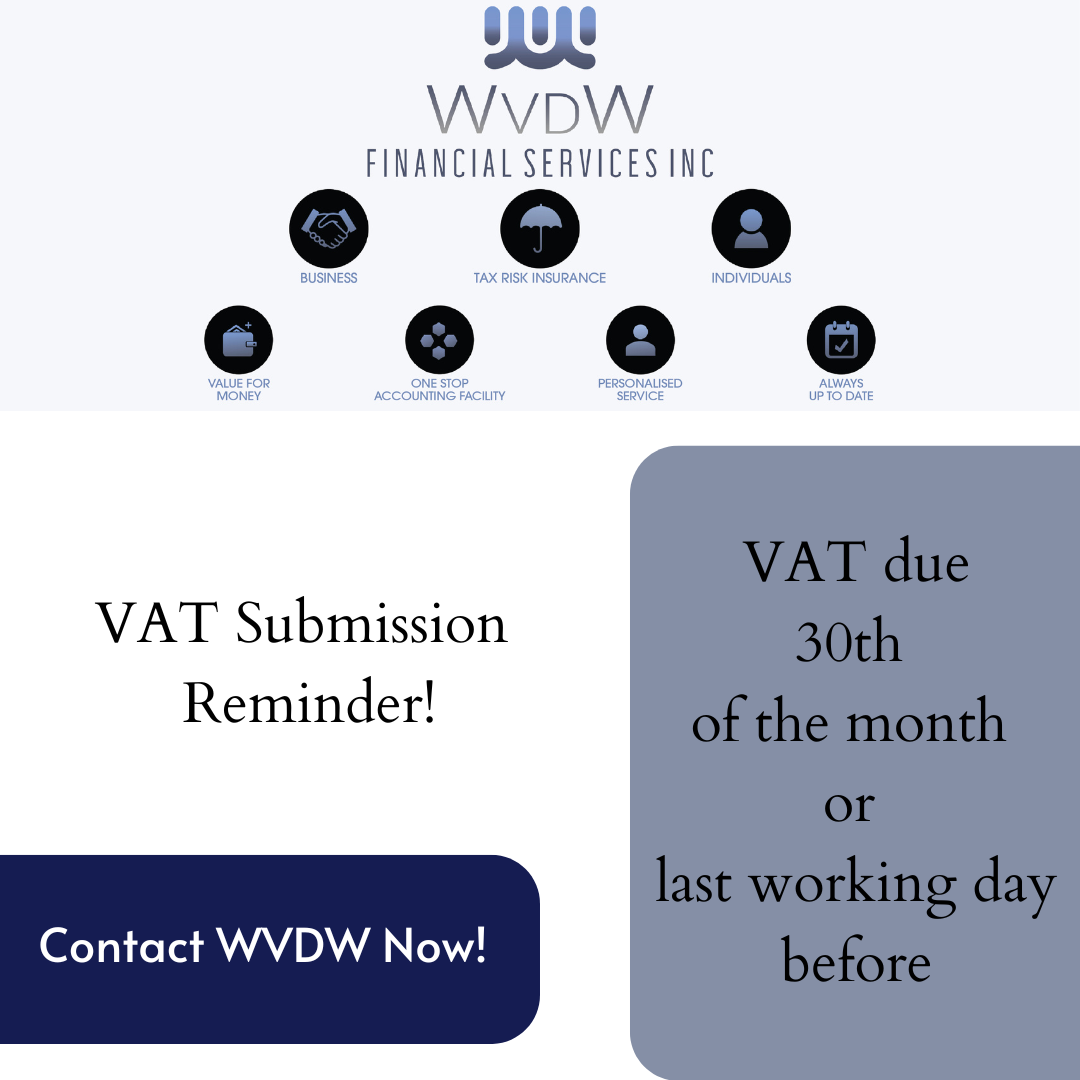

VAT Reminder – Friday 27th February 2025

VAT is due on the 30th of the month or the last working day before. VAT assistance by WVDW. If you have any queries, please contact our offices for assistance. 011 476 1112 info@wvdw.co.za #WVDW #WVDWFinancialServices #MBServices #bookkeepers #accountants...

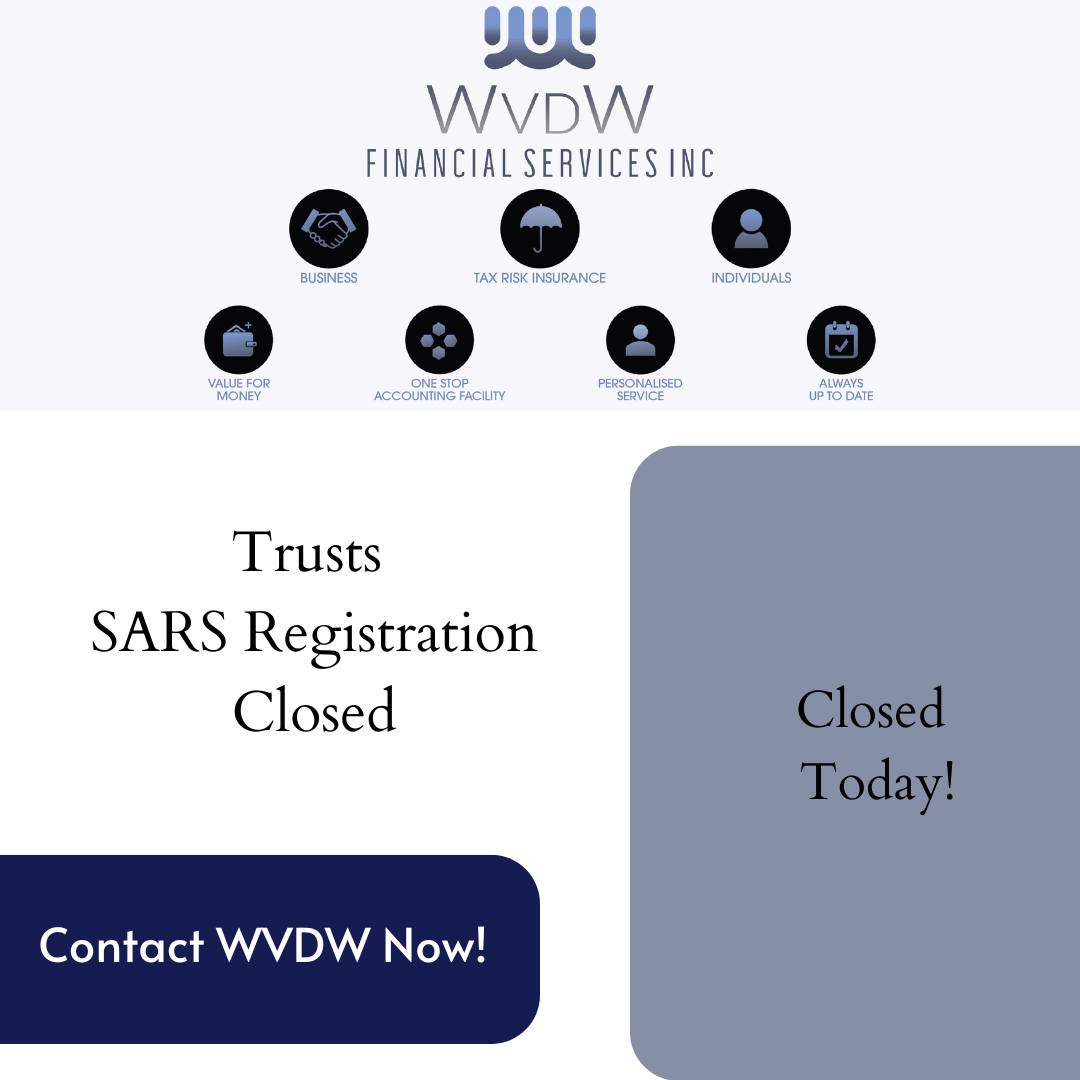

Trusts SARS Registration Close Today!

Trust SARS Registration close today. If your trust hasn't been registered with SARS, you should do so as soon as possible. Reminder, filing from 19 September 2025 – 19 January 2026. Trusts tax assistance by WVDW. If you have any queries, please contact our offices for...

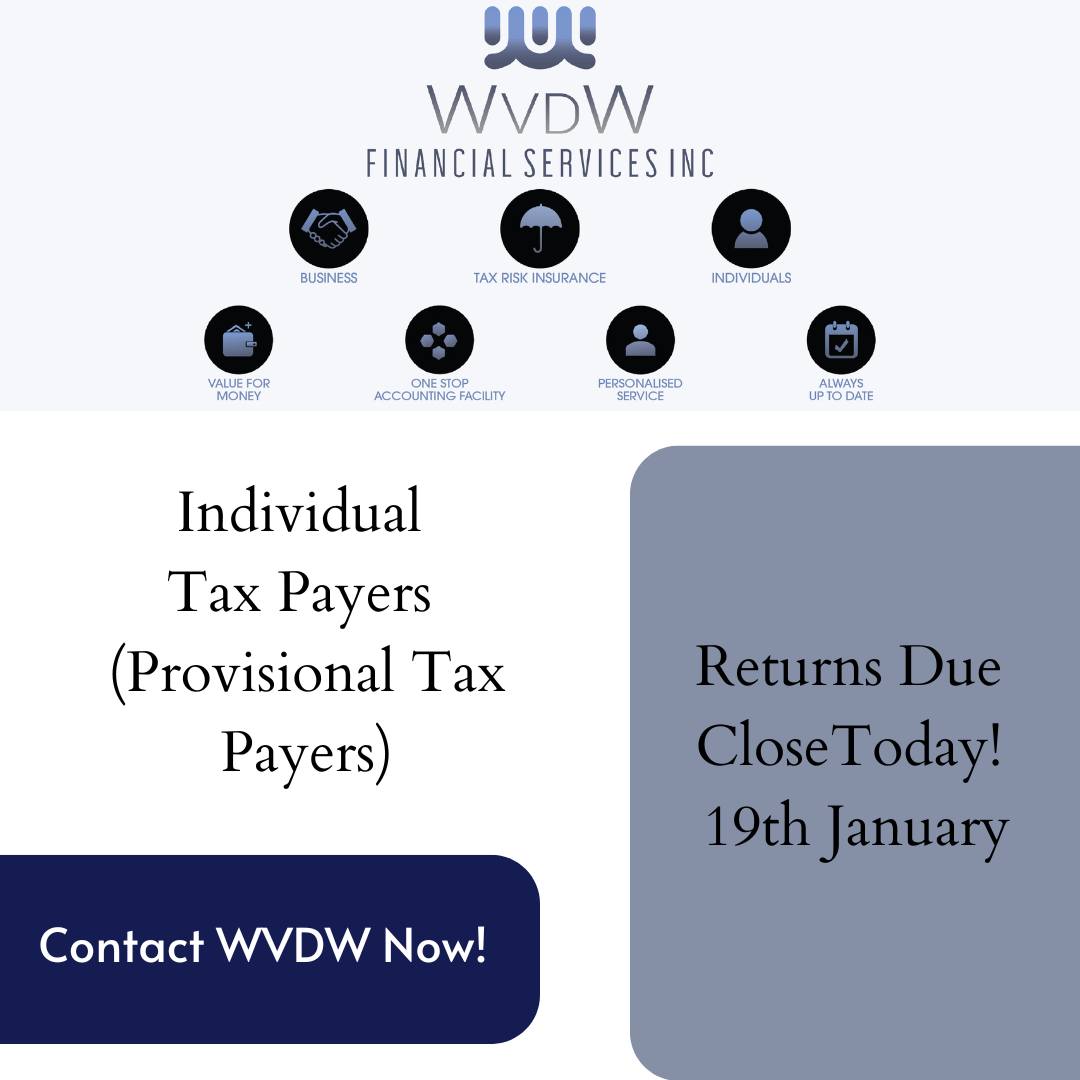

Individual Tax Payers – Returns Close Today

That’s The Tax Season – Auto Assessments, Non-Provisional & Provisional Submissions Close! Miss(ing) your deadline? We can help! Tax season doesn’t need to be stressful or time-consuming. At WVDW, we offer a comprehensive personal tax service that takes care of...

Testimonials

Jeanette

Wessie and his team at WvdW has been looking after my personal income tax for several years. The team understands my family needs and will accommodate me as much as possible. As a family we recently moved our last will and testament also to WvdW and trust them to look after our needs even after we gone. I can highly recommend the team at WvdW.

GreatSoft (Pty) Ltd

“GreatSoft has been utilising the services of WvdW for more than 10 years, on a monthly basis. Their professionalism and attention for detail is unquestionable top quality and I can highly recommend their services. We are treated with the utmost respect when we have any queries with a feeling of understanding and respect from partner level to the clerks. I can highly recommend using WvdW”

– Jean Pick (Managing Director)

Stationery Labels CC

“The daily running of a business requires much multifaceted focus, on staff, customers, suppliers, the marketplace, the list is endless. Sound accounting policies and practises are of paramount importance, as is a good accountant, a firm which can guide and execute these sound policies….. a firm such as WvdW, always reliable, efficient, keeping the accounting facet of your business well cared for.”